Welcome! Where would you like to log in today?

Sign up and get PRO free for 14 days.

Once your PRO trial is over you can continue using Landlord Studio GO completely free.

By continuing you agree to our Terms & Conditions.

Keep accurate and up to date digital records throughout the year and gain nuanced portfolio insights and make tax time easy our industry-specific financial reports.

Keep an eye on taxable income and allowable property expenses with powerful reports and instant dashboard insights.

Instantly generate and share any of our accountant-approved reports with a few quick taps for a streamlined tax time. Our expense categories are designed for landlords and are in line with property tax requirements.

SIGN UP TO LANDLORD STUDIO

Instantly generate accountant-approved financial reports including our specially designed Profit and Loss report.

Real time income expense tracking

Scan receipts, connect bank accounts to reconcile transactions, and automate mileage tracking.

Download tax reports

Instantly generate any of our tax reports including the Profit and Loss as .CSV or PDF files.

With expense categories designed for the property sector, time-saving bookkeeping tools you can use on the go, and a range of powerful reports it’s easier than ever to calculate tax on rental income, maximise deductions, and improve profitability.

Stay on top of your rental property bookkeeping throughout the year with advanced cloud-based accounting tools including bank feeds for fast expense reconciliation and automated income tracking.

Discover rental accounting.png)

Give your accountant access to your financial data and easily share reports and documents with property owners and business partners and ensure your books are error free.

Use our Xero integration to seamlessly sync all your financial data to Xero, avoid double-handling of data and increase your accounting accuracy.

Discover integrations

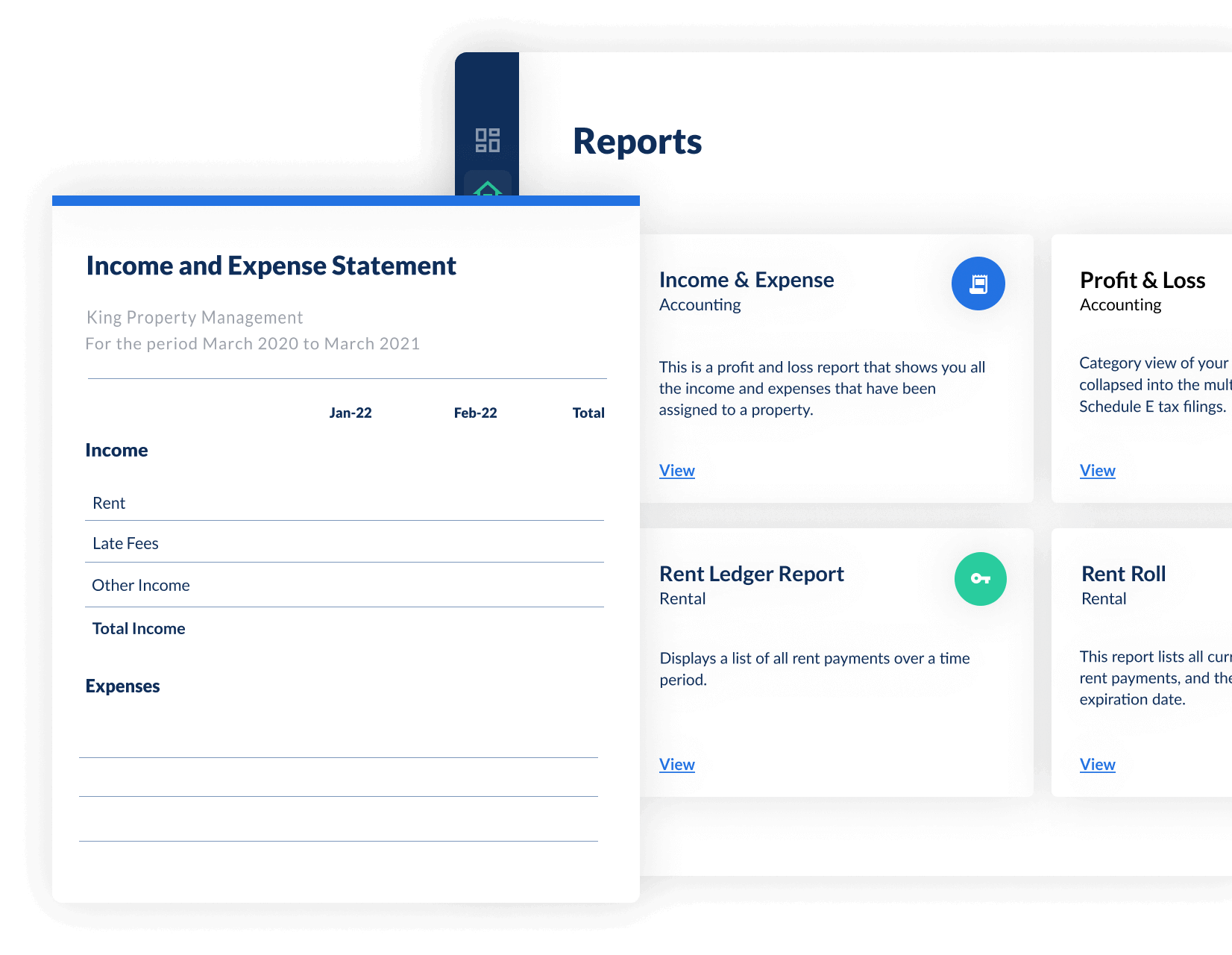

We've a range of powerful reports designed to ensure you are able to maximise return on investment and have a stress free tax season.

Basic reports include

Can be exported as PDFs and include:

ADVANCED REPORTS INCLUDE

Can also be exported as fully editable CSV files and include:

Landlord Studio will be directly integrated with the HMRC before the 2026 MTD for ITSA deadline. You can also use our Xero integration to become MTD compliant today.

Find out more about MTD.

You can share reports easily with just a few taps, or invite your accountant to access your reports at any time.

Find out about our accounting software integrations.

Here’s the complete flow for logging income and tracking expenses on our mobile and desktop apps. Find out more about rental accounting here.

Take a picture of a receipt using your phone and Landlord Studio will read and inputs the receipt details for you and save the digitised receipt to our secure cloud server so you can access it at any time. Learn more.

Our reports can be easily filtered so that you can easily extract the exact data you need to make informed decisions about your property business. Filter by date range, property or unit, owner, income and expense categories and more. Learn more.

Can’t find the answer your looking for? Please chat to our friendly team or check out our blog here.

Get in touch